Ab Asaan Hai!

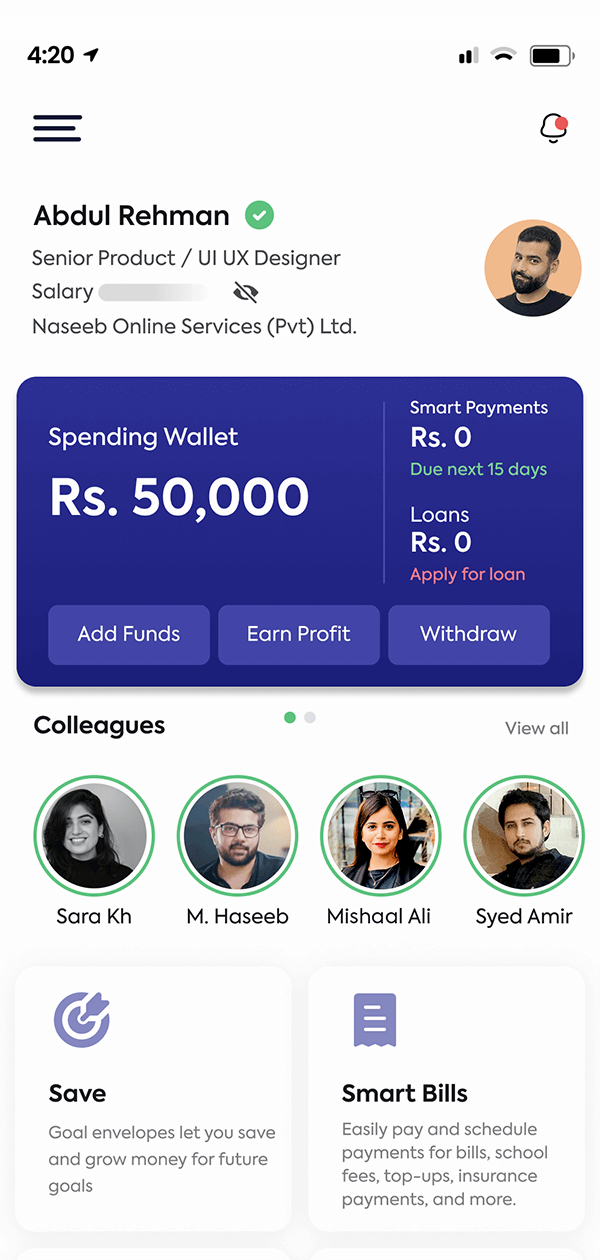

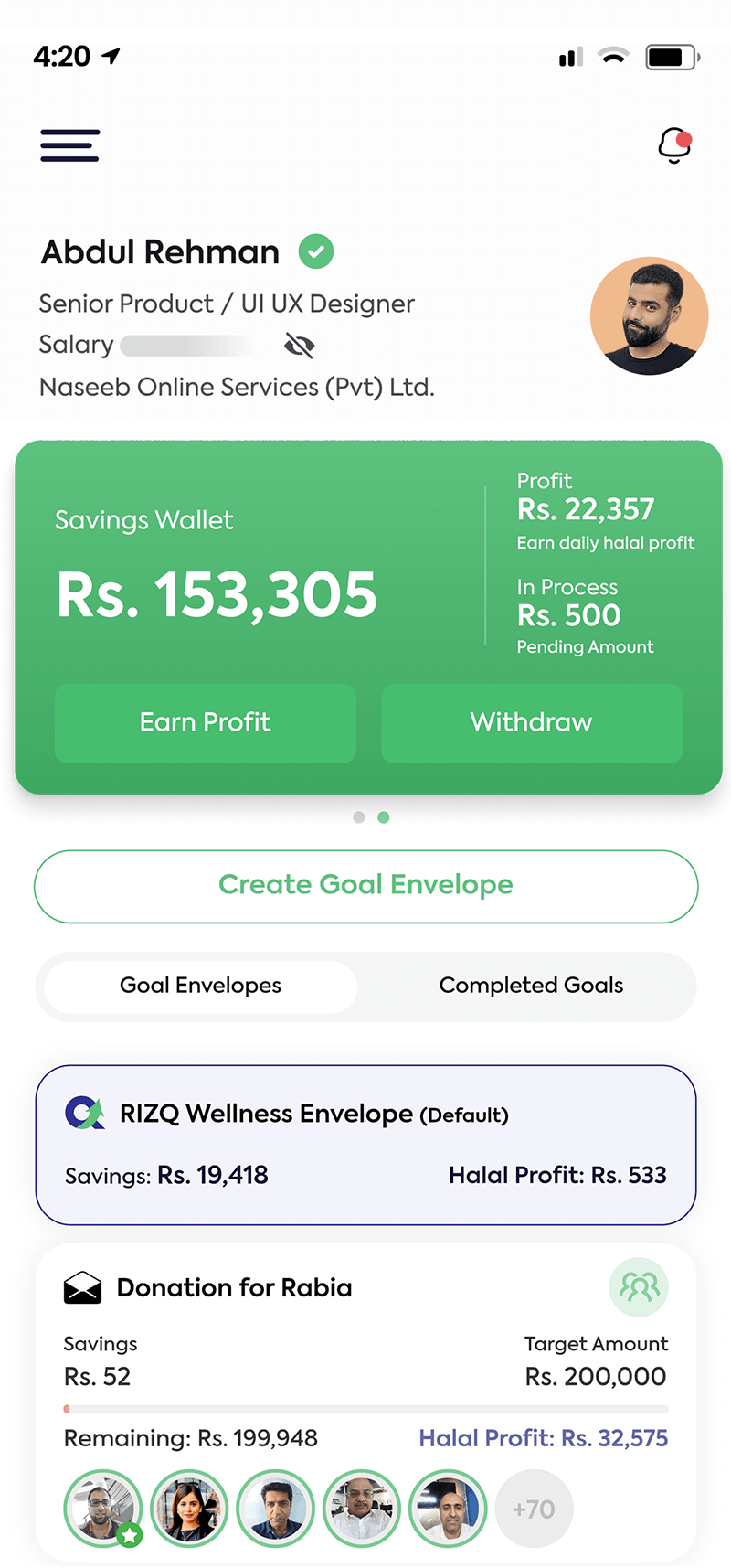

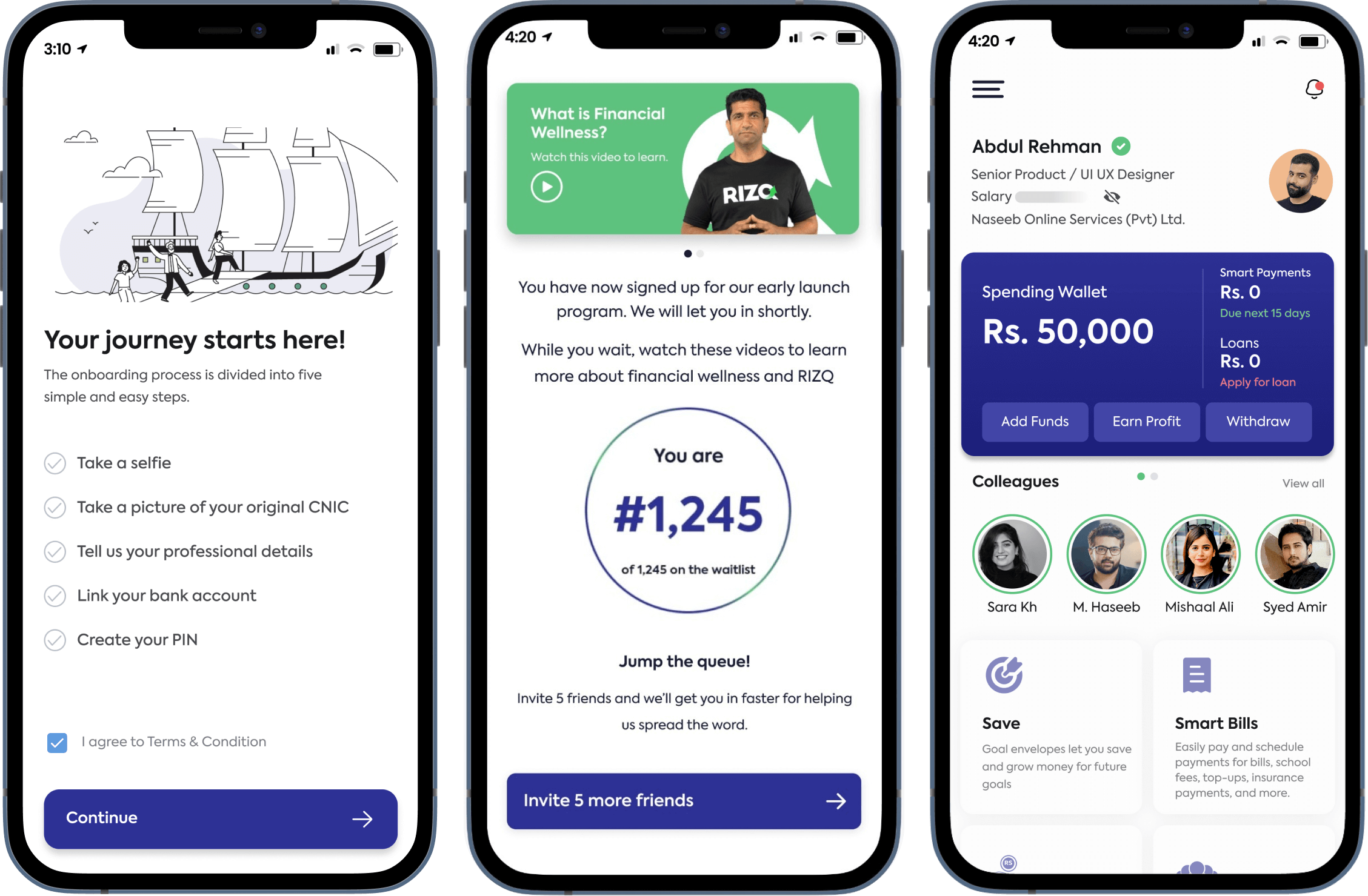

Welcome to the world of RIZQ! Experience RIZQ by Rozee, the all-in-one super-app crafted for professionals and freelancers. Streamline your saving, investing, borrowing, and financial planning effortlessly.

Make your

money work for

you!

RIZQ helps Professionals and Freelancers attain financial security by simplifying money management tools and providing access to licensed financial solutions and income generation streams.

Master the tools for Financial Wellness

with RIZQ Wellness Buddies and

in-app explainer videos

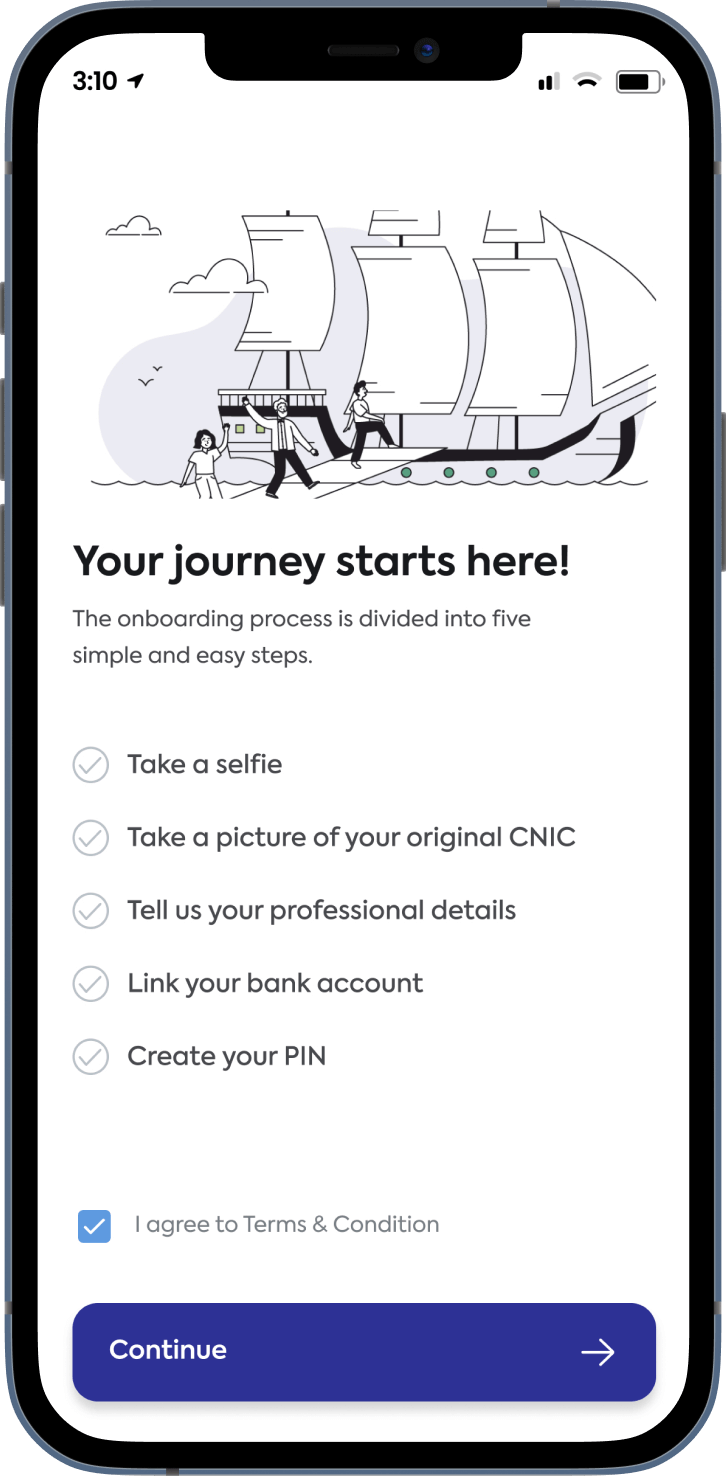

Join the waitlist and start your journey with us

Install AppQuestions & Answers

RIZQ by Rozee is an easy-to-use financial wellness super app that offers several money management features and services like daily halal profits, goal-based savings, committees, loans, smart online payment, health insurance, and more. RIZQ acts as your Financial Passport and opens doors to a new world of one-tap financial possibilities. RIZQ services are offered in partnership with third-party licensed institutions.

Go to your dashboard and tap on the Add Funds button. There you will see all the required information like the account title and account number of your RIZQ wallet. Add funds to your unique account via online transfer through your bank account and your RIZQ wallet will be updated.

Get RIZQ and open doors to a world of

one-click financial possibilities!

Financial Wellness

Ab Asaan Hai!